colorado springs sales tax rate 2021

File a Sales and Use Tax Return. The base state sales tax rate in Colorado is 29.

.jpg)

Hvs 2021 Hvs Lodging Tax Report Usa

The Colorado sales tax rate is currently.

. Method to calculate Colorado Springs sales tax in 2021. The minimum combined 2022 sales tax rate for Colorado Springs Colorado is. What is the sales tax rate in Colorado Springs Colorado.

Sales and Use Tax Increase 3. This is the total of state county and city sales tax rates. The combined amount is.

Colorado state sales tax is imposed at a rate of 29. The Colorado sales tax rate is currently. Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date.

Tax Rate 307 effective January 1 2021 -current. Download all Colorado sales tax rates by zip code. The minimum combined 2022 sales tax rate for Manitou Springs Colorado is.

Local tax rates in Colorado range from 0 to 83 making the sales tax range in Colorado 29 to 112. City of Colorado Springs Sales and Use tax rate is 307 city collected State of Colorado 29 El Paso County Rate is 123 PPRTA Rate is 10 all 3 entities state collected. City of Colorado Springs Sales and Use tax rate is 307 city collected State of Colorado 29 El Paso County Rate is 123 PPRTA Rate is 10 all 3 entities state collected.

825 Is this data incorrect The Colorado Springs Colorado sales tax is 825 consisting of 290 Colorado state sales tax and 535 Colorado Springs local sales. Returns must be filed even if no tax is due to city. This is the total of state county and city sales tax.

Any sale made in Colorado may also be subject to state-administered local sales taxes. 31 rows Centennial CO Sales Tax Rate. Recent Colorado statutory changes require retailers to charge collect and remit a new fee.

Tax rate information for state-administered. Colorado Springs CO Sales Tax Rate. Commerce City CO Sales Tax Rate.

This is the total of state county and city sales tax rates. Beginning July 1 2022 retailers must collect a 027 retail delivery fee on every retail. As we all know there are different sales tax rates from state to city to your area and everything combined is the.

Effective January 1 2021 the City of Colorado Springs sales and use tax rate has decreased from 312 to 307 for all transactions occurring on or after that date. Denver CO Sales Tax Rate. You can print a 82.

The 82 sales tax rate in Colorado Springs consists of 29 Colorado state sales tax 123 El Paso County sales tax 307 Colorado Springs tax and 1 Special tax. While Colorado law allows. You are responsible for filing a return by the due date.

The Colorado Springs Colorado sales tax is 290 the same as the Colorado state sales tax. The minimum combined 2022 sales tax rate for Steamboat Springs Colorado is.

Colorado Sales Tax Calculator And Local Rates 2021 Wise

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

2022 State Tax Reform State Tax Relief Rebate Checks

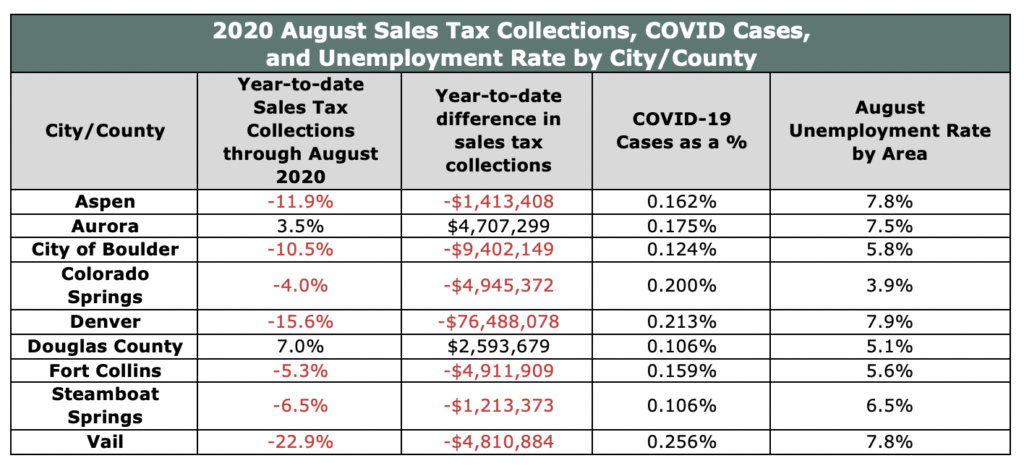

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Colorado Sales Tax Rates By City County 2022

Colorado Springs Rejected Retail Pot In 2022 But These Colorado Towns Didn T Westword

Colorado Income Tax Calculator Smartasset

The Cost Of Living In Colorado Springs In 2022 Rent Blog

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Taxes In Colorado Springs Living Colorado Springs

Sales Tax Information Colorado Springs

Heidi Ganahl Says She Will Eliminate Colorado S Income Tax But Not How

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator

State And Local Sales Tax Rates Sales Taxes Tax Foundation

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)

The Best And Worst States For Sales Taxes

Sales Tax Information Colorado Springs

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

Living In Colorado Springs 12 Things You Need To Know Pods Blog